Feb 8, 2024

How to Optimize Customer Acquisition Costs (CAC).

Have you ever wondered how much it really costs to bring in a new customer? Understanding how to optimize your Customer Acquisition Cost (CAC) is like unlocking a secret code to profitability. In this guide, we’ll dive deep into why CAC matters, its monitoring, evaluation, risks, and future trends.

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) refers to the cost a company incurs to acquire a new customer. It takes into account all the expenses associated with marketing, sales, and lead generation efforts. These are necessary to attract and convert potential customers into paying customers. CAC is a crucial metric because it directly impacts a company’s profitability and overall business growth.

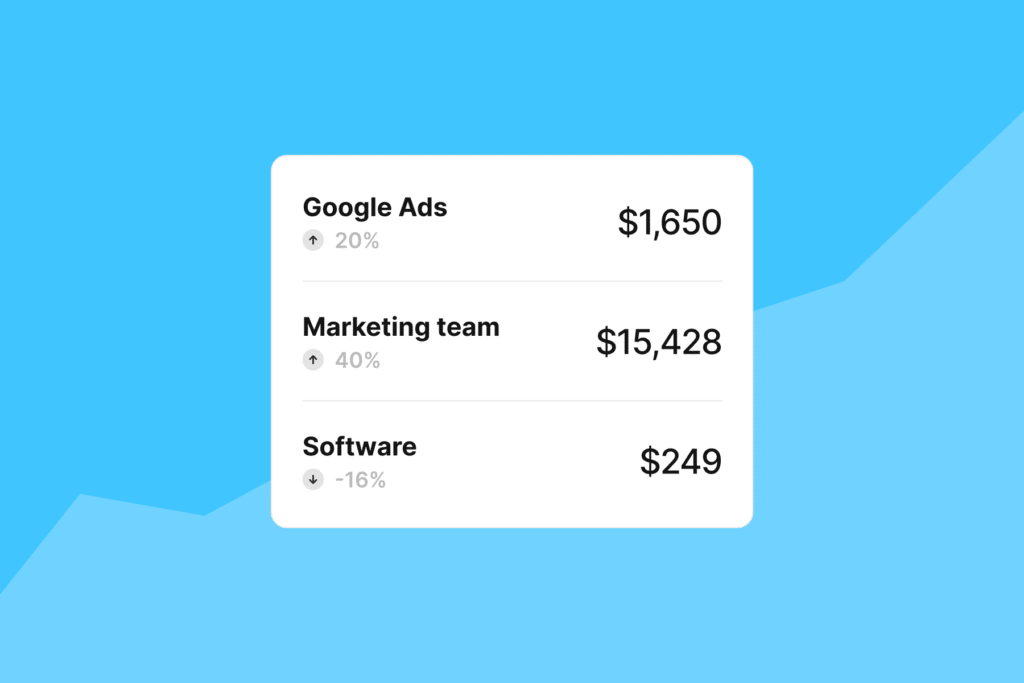

When it comes to understanding CAC, it is important to consider the various components that contribute to this cost. Marketing expenses include advertising costs, promotional campaigns, and any other activities aimed at creating awareness and generating leads. Sales expenses encompass the salaries and commissions of sales representatives, as well as any costs associated with closing deals. Lead generation expenses involve the costs of acquiring leads through various channels, such as online advertising, content marketing, and events. Costs have risen dramatically, with studies showing a 222% increase in CAC eCommerce between 2013 and 2022. Let’s get into the importance of CAC for your eCommerce business.

The Importance to Optimize CAC in Business

CAC is a key performance indicator (KPI) that provides insights into the effectiveness and efficiency of a company’s customer acquisition efforts. By understanding CAC, businesses can make informed decisions about resource allocation, marketing campaigns, and sales strategies. Optimizing CAC is essential for maximizing revenue and ensuring a healthy return on investment (ROI).

One of the main benefits of monitoring CAC is to identify areas where costs can be reduced or reallocated. The formula for calculating CAC is straightforward:

- Sum up all the costs related to marketing, advertising, sales, and lead generation.

- Divide the total cost by the number of new customers acquired during the same period.

CAC calculations should always consider the timeframe in which both the costs were incurred and the customers were acquired. This allows for a more accurate representation of the efficiency of customer acquisition efforts. Companies may choose to calculate CAC on a monthly, quarterly, or annual basis, depending on their business model and industry.

By regularly calculating and tracking CAC, companies can identify trends, effectiveness of different marketing channels, and make data-informed decisions.

Strategies to Optimize CAC

To optimize CAC effectively, businesses need to focus on improving marketing efficiency, enhancing sales productivity, and leveraging technology. For further implementation of these strategies, companies can effectively reduce customer acquisition costs and increase their return on investment.

Improving Marketing Efficiency to Optimize CAC

One way to improve marketing efficiency is to target the right audience. By understanding customer demographics, preferences, and behavior, businesses can create personalized marketing campaigns that resonate with potential customers. This targeted approach not only increases the chances of converting leads, but also minimizes wasted marketing efforts and resources.

In addition to targeting the right audience, leveraging digital marketing tactics such as search engine optimization (SEO), social media advertising, and content marketing can help increase brand visibility and attract qualified leads. SEO ensures that a company’s website appears prominently in search engine results, driving organic traffic and improving the chances of customer acquisition.

Social media advertising allows businesses to reach a wider audience and engage with potential customers on platforms they frequent. Content marketing, on the other hand, enables companies to establish thought leadership, build trust, and educate potential customers about their products or services.

Enhancing Sales Productivity

Streamlining sales processes is crucial for enhancing sales productivity. By identifying and eliminating bottlenecks, companies can ensure that leads move smoothly through the sales funnel. This will help by reducing the time and effort required to convert them into paying customers. It can be achieved by implementing efficient lead management systems, automating repetitive tasks, and providing sales teams with the necessary tools and resources.

Another way to enhance sales productivity is through sales training and incentives. By investing in continuous training programs, companies can equip their sales teams with the skills and knowledge needed to effectively engage with potential customers, address their pain points, and close deals. Incentives, such as commissions or bonuses tied to performance, can motivate sales teams to go the extra mile.

Leveraging Technology to Optimize CAC

The use of technology can greatly optimize CAC. By leveraging customer relationship management (CRM) systems, companies can effectively track and manage customer interactions, analyze customer data, and identify areas for improvement. CRM systems provide a centralized database that allows businesses to have a holistic view of their customers. They can use this to enable personalized communication and targeted marketing campaigns.

Automation tools also play a significant role in optimizing CAC. Email marketing automation, for example, allows companies to send personalized and timely emails to potential customers, nurturing them through the sales funnel. This not only saves time but also ensures that leads are consistently engaged and informed about the company’s offerings. Lead nurturing software, on the other hand, enables businesses to automate the process of nurturing leads with relevant content, ensuring that potential customers are continuously engaged and moving closer to making a purchase decision.

Optimizing CAC requires a comprehensive approach that involves improving marketing efficiency, enhancing sales productivity, and leveraging technology. By implementing these strategies, businesses can effectively reduce customer acquisition costs, increase their conversion rates, and ultimately drive business growth.

Monitoring and Evaluating CAC

Monitoring and regularly evaluating customer acquisition cost (CAC) is crucial to ensure ongoing optimization and success. By closely monitoring CAC, businesses can gain valuable insights into the effectiveness of their customer acquisition efforts and make informed decisions to improve their strategies.

When it comes to evaluating CAC, it is important to consider not only the cost itself but also other key metrics related to customer acquisition. These metrics provide a holistic view of a company’s customer acquisition efforts and help identify areas for improvement.

Key Metrics for CAC Evaluation

In addition to CAC itself, businesses should track other key metrics related to customer acquisition, such as customer lifetime value (CLTV), customer churn rate, and conversion rates. These metrics provide a deeper understanding of the overall effectiveness and efficiency of a company’s customer acquisition process.

Customer lifetime value (CLTV) is a metric that measures the total value a customer brings to a business over the course of their relationship. By calculating CLTV, businesses can determine the profitability of acquiring and retaining customers, allowing them to allocate resources more effectively.

Customer churn rate, on the other hand, measures the percentage of customers who stop using a product or service over a given period. By tracking this metric, businesses can identify any issues or pain points that may be causing customers to leave, enabling them to take proactive measures to improve customer retention. Returning customers now spend on average 61% more than new customers, increased by upselling and trust with eCommerce stores. Similarly, customer referrals have a higher retention rate of 37% and 16% CLV.

Conversion rates, another important metric, measure the percentage of visitors or leads who take a desired action, such as making a purchase or signing up for a newsletter. By analyzing conversion rates, businesses can identify areas of their customer acquisition funnel that may need optimization, ultimately leading to increased conversions and revenue.

Regular Monitoring of CAC

Given that the business landscape is constantly evolving, regular monitoring of CAC is essential. By tracking CAC on an ongoing basis, businesses can identify any significant changes, trends, or deviations that require immediate attention and adjustment. To measure this effectively, use Lifetimely by AMP. It provides deep insights into CAC, CLV and customer behavior so you can identify the biggest revenue opportunities and growth strategies.

Regular monitoring allows businesses to stay proactive in their optimization efforts, ensuring that CAC remains within acceptable ranges. By identifying any sudden spikes or declines in CAC, businesses can quickly investigate the underlying causes and take appropriate actions to maintain cost-effectiveness in their customer acquisition strategies.

Moreover, regular monitoring of CAC enables businesses to stay ahead of the competition. By keeping a close eye on industry benchmarks and trends, businesses can adjust their strategies accordingly and maintain a competitive edge in the market.

In conclusion, monitoring and evaluating CAC, along with other key metrics, is vital for businesses to optimize their customer acquisition efforts. By regularly tracking and analyzing these metrics, businesses can identify areas for improvement, make data-driven decisions, and ultimately achieve long-term success in acquiring and retaining customers.

Risks of Not Optimizing CAC

Failure to optimize CAC can have significant financial implications and hinder business growth.

Financial Implications

High CAC means that a company is spending too much money to acquire each customer. This can lead to reduced profitability and inefficient use of resources. Optimizing CAC allows for cost savings, increased revenue, and better financial performance overall.

Impact on Business Growth

CAC optimization directly impacts business growth. By reducing CAC, companies can acquire more customers with the same budget, expanding their customer base and market share. Efficient customer acquisition paves the way for sustainable growth, market expansion, and increased competitiveness.

Future Trends to Optimize CAC

The future of CAC optimization holds exciting possibilities with the advancement of technology.

Role of AI in CAC Optimization

Artificial Intelligence (AI) plays a significant role in CAC optimization. AI-powered algorithms and machine learning models can analyze vast amounts of data to identify patterns, preferences, and predict customer behavior. By leveraging AI, businesses can target their marketing efforts more effectively, personalize customer experiences, and optimize CAC in real-time.

Predictive Analytics and CAC

Predictive analytics is another future trend in CAC optimization. By using historical data and applying predictive models, businesses can forecast customer acquisition costs, identify potential bottlenecks in the customer journey, and make proactive adjustments to optimize CAC. Predictive analytics empowers businesses to make data-driven decisions and optimize customer acquisition strategies for maximum impact.

Optimizing CAC is crucial for businesses looking to thrive and succeed in a competitive market. By understanding CAC, implementing effective strategies, and embracing future trends, businesses can constantly improve their customer acquisition efforts, drive revenue growth, and achieve long-term success.

Make pre & post-purchase offers that increase AOV

Start today,

for free

Start a free trial of any of AMP’s tools today.