Feb 16, 2024

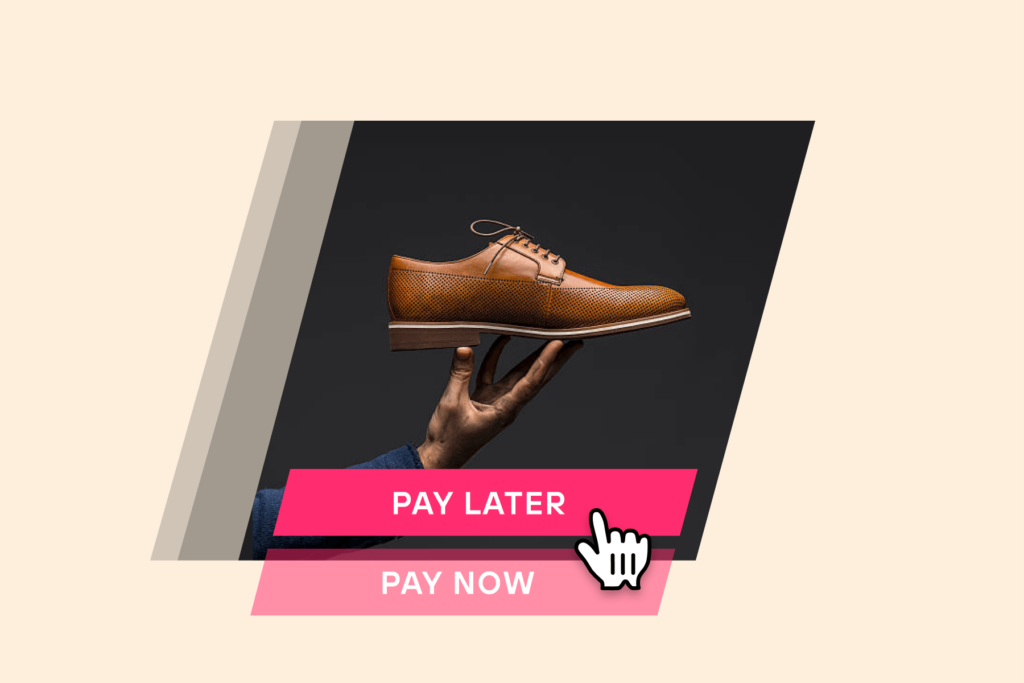

Buy Now Pay Later: Everything You Need to Know.

Buy now pay later (BNPL) has become a popular payment option for consumers. It provides them with greater flexibility when making purchases. Whether you’re eyeing a new gadget, planning a home renovation, or simply need to cover unexpected expenses, BNPL offers a convenient solution. Let’s explore the concept of BNPL, its advantages, potential risks, how it works, tips for choosing the right service, and how to use it responsibly.

The Basics of Buy Now Pay Later

At its core, BNPL allows consumers to make purchases and delay payment until a later date. This flexible payment option breaks down the total cost into installment payments, which can be spread out over time. This means you can enjoy your purchase immediately without having to pay the full amount upfront.

But how does BNPL actually work? Let’s dive deeper into the process.

How Does It Work?

When you choose to buy now and pay later, you typically have to sign up for an account with a BNPL service provider. This account allows you to make purchases from participating merchants and delay the payment. Once you’ve made a purchase, the BNPL service provider pays the merchant on your behalf. You are then responsible for repaying the service provider in installments.

One of the key advantages of BNPL later is the flexibility it offers. Instead of paying the full amount upfront, you can spread out the payments over a period of time. This will making it easier to manage your finances. Additionally, BNPL often comes with interest-free options, allowing you to make purchases without incurring any additional costs.

The Evolution of Buy Now Pay Later

In recent years, BNPL has experienced significant growth and evolution. Initially, it was offered by individual merchants as an alternative financing option. However, with the rise of fintech companies, dedicated BNPL services have emerged, offering consumers a wide range of options for making purchases and delaying payment.

With the advent of technology, buy now pay later services have become more accessible and convenient. Many providers now offer online platforms and mobile apps, making it easier for consumers to browse and shop from a variety of merchants. These platforms also provide features such as real-time payment tracking, automated reminders, and personalized recommendations, enhancing the overall user experience.

Furthermore, BNPL services have expanded their offerings beyond traditional retail purchases. Consumers can now use this payment option for a variety of expenses, including travel bookings, utility bills, and even healthcare expenses. This versatility has made BNPL a popular choice among consumers looking for a convenient and flexible payment solution.

Another notable development in the BNPL industry is the integration of artificial intelligence and machine learning. By analyzing consumer spending patterns and creditworthiness, these technologies enable BNPL providers to offer personalized payment plans and tailored recommendations. This not only helps consumers make informed financial decisions but also reduces the risk of default for the service providers.

In conclusion, BNPL has evolved from a niche financing option to a mainstream payment solution. With its flexibility, convenience, and expanding range of offerings, it has become a popular choice among consumers. Whether you’re looking to make a big-ticket purchase or simply want to manage your expenses more effectively, buy now pay later can provide you with the financial flexibility you need.

The Pros and Cons of Buy Now Pay Later

BNPL has become an increasingly popular payment option, offering consumers the flexibility to make purchases without having to pay immediately. This payment method has its advantages and disadvantages, which we will explore in detail below.

Advantages of Buy Now Pay Later

One of the key advantages of BNPL is the ability to make purchases without having to pay immediately. This can be particularly beneficial for larger purchases, such as furniture or electronics, allowing you to spread out the cost over several installments. By breaking down the payment into manageable chunks, BNPL makes it easier for individuals to afford items.

Another advantage of BNPL is the interest-free periods that are often offered. During these periods, you have the opportunity to pay off your balance without incurring any additional charges. This can be especially useful if you need some extra time to manage your finances or if unexpected expenses arise. By taking advantage of interest-free periods, you can avoid paying unnecessary interest and save money in the long run.

Potential Risks of Buy Now Pay Later

While buy now pay later can be a convenient payment option, it’s important to be aware of the potential risks involved. One of the main risks is the temptation to overspend. The deferred payments may lead to a false sense of affordability, making it easy to make impulse purchases or buy items that are beyond your budget. It’s crucial to exercise self-discipline and only use buy now pay later for necessary purchases that you can comfortably afford to pay off in the future.

Another potential risk of BNPL is the possibility of late payments or missed installments. If you fail to make your payments on time, you may incur late fees or high interest rates, which can quickly add up and lead to financial difficulties. It’s important to carefully manage your payment schedule and set reminders to ensure that you make your payments on time. By doing so, you can avoid unnecessary charges and maintain a good credit score.

How Does BNPL Work?

BNPL services have become increasingly popular in recent years, offering consumers a convenient way to make purchases without having to pay the full amount upfront. But how exactly does this payment option work?

The Process of Buy Now Pay Later

When using a buy now pay later service, the process typically involves signing up for an account and undergoing a brief approval process. This usually requires providing some personal information and undergoing a credit check to determine your eligibility. Once approved, you can start using the service to make purchases.

When you’re ready to make a purchase, you can shop at participating merchants and select the buy now pay later option at checkout. This option is usually displayed alongside other payment methods, such as credit cards or PayPal. By choosing this option, you’re essentially agreeing to defer your payment and pay for the purchase at a later date.

After selecting the BNPL option, you’ll then be able to choose your desired repayment plan. These plans typically offer different options, such as paying in full within a specific timeframe or spreading the payments over several months. The availability of repayment plans may vary depending on the buy now pay later service and the merchant you’re purchasing from.

Once you’ve selected your repayment plan, you can complete the purchase without paying the full amount upfront. Instead, you’ll be required to make regular payments according to the terms of your chosen plan. These payments can usually be made online through the buy now pay later service’s website or app.

Interest Rates and Fees

It’s important to carefully review the terms and conditions of any BNPL later service to understand the interest rates and fees involved. While some services may offer interest-free periods, others may charge interest from the start. The interest rate can vary depending on factors such as your creditworthiness and the specific buy now pay later service you’re using.

In addition to interest rates, late fees and penalties may apply if payments are not made on time. These fees can add up quickly and impact your overall cost. Therefore, it’s crucial to make sure you understand the payment schedule and set reminders to avoid any late payments.

Furthermore, some BNPL services may charge additional fees for certain services, such as early repayment or changing your repayment plan. It’s essential to be aware of these potential fees and factor them into your decision-making process.

By being aware of the interest rates, fees, and potential penalties associated with buy now pay later services, you can make informed decisions when using this payment option. It’s always a good idea to compare different services and read reviews to find the one that best suits your needs and offers the most favorable terms.

Choosing the Right BNPL Service

When selecting a buy now pay later service, there are several factors to consider. First, evaluate the available merchants and ensure that the service is accepted at the retailers you frequently shop with. Look into the interest rates and fees associated with the service to determine if they align with your financial goals. Also, consider the reputation and customer reviews of the service provider to ensure a positive experience.

Comparing Different Services

With numerous BNPL services available, it’s important to compare the options to find the one that best suits your needs. Take into account the repayment terms, such as the duration of the installment plan and the frequency of payments. Additionally, assess any additional features or benefits offered by the service, such as early payment options or rewards programs.

Buy now pay later offers a convenient option for consumers to make purchases and delay payment. Understanding the basics, weighing the pros and cons, and choosing the right service will help you make informed decisions. By using buy now pay later responsibly and avoiding common pitfalls, you can enjoy the benefits of this payment option while maintaining financial stability.

AMP up your eCommerce Platform!

Start today,

for free

Start a free trial of any of AMP’s tools today.