Nov 27, 2023

How to Calculate Average Revenue: A Comprehensive Guide.

Average revenue is an important concept to understand your financial performance. It will help you calculate your sales and make informed decisions. In this guide, we will explore average revenue, it’s importance, and ways to use it for your business.

Understanding the Concept of Average Revenue

When we talk about average revenue, we are referring to the revenue generated per unit of output. In other words, it is the average amount of revenue a business receives for each unit of goods or services sold. To calculate average revenue, you need to divide the total revenue by the quantity of sold goods.

Importance of Calculating Average Revenue

Average revenue is a key metric that enables businesses to assess their financial performance and make well-informed decisions. It provides valuable insights into the effectiveness of pricing strategies, identify revenue streams, and serves as a foundation for forecasting and budgeting.

One of the primary uses of average revenue is to evaluate the success of pricing strategies. By comparing the average revenue per unit to the cost of production, businesses can determine whether their pricing is generating enough profit to cover expenses and generate a desirable margin.

Moreover, average revenue helps businesses identify their most profitable revenue streams. By analyzing the average revenue generated by different products or services, businesses can allocate resources and focus on the areas that yield the highest returns.

Additionally, average revenue serves as a foundation for forecasting and budgeting. By analyzing historical average revenue data, businesses can make informed predictions about future revenue and plan their budgets accordingly. This allows them to allocate resources efficiently and set realistic financial goals.

By understanding and utilizing average revenue effectively, businesses can make informed decisions and drive sustainable growth.

Components when you Calculate Average Revenue

Several factors contribute to the calculation of average revenue. Understanding these components is crucial for accurately determining this essential metric.

When analyzing the components of average revenue, it is important to consider not only the total revenue generated by a business but also the quantity of goods or services sold.

Total Revenue

Total revenue refers to the overall income a business generates from the sale of goods or services. It encompasses revenue from all sources and is a fundamental element in calculating average revenue.

For example, a retail store’s total revenue would include income from sales of various products, such as clothing, electronics, and home goods. Additionally, it would also include revenue from any additional services offered, such as repairs or installations.

Understanding the total revenue is essential as it provides a comprehensive view of the business’s financial performance. By analyzing the total revenue, businesses can identify their main sources of income and assess the effectiveness of their pricing strategies.

Quantity of Goods or Services Sold

The quantity of goods or services sold represents the number of units a business delivers to customers. This figure is an integral part of computing average revenue and directly affects the final result.

When calculating average revenue, it is important to consider how the quantity of goods or services sold impacts the overall revenue. For instance, if a business sells a large quantity of low-priced items, it may result in a higher total revenue but a lower average revenue per unit.

On the other hand, if a business focuses on selling a smaller quantity of high-priced items, it may result in a lower total revenue but a higher average revenue per unit. Understanding this relationship between quantity and average revenue is crucial for making informed business decisions.

Moreover, analyzing the quantity of goods or services sold can provide insights into customer demand and preferences. By monitoring changes in the quantity sold, businesses can identify trends and adjust their production or marketing strategies accordingly.

Step-by-Step Guide to Calculate Average Revenue

Now that we have established the foundation, let’s delve into the process of calculating average revenue. Follow these steps to accurately determine this essential metric for your business.

Calculating average revenue is a crucial task for any business owner or manager. It provides valuable insights into the financial performance of the company and helps in making informed decisions. By understanding the average revenue per unit, you can assess the effectiveness of your pricing strategies, identify areas for improvement, and set realistic revenue targets.

Identifying Your Total Revenue

To begin, gather all relevant information on your total revenue. This includes income from various sources, such as product sales, service fees, and any other revenue streams you may have.

When identifying your total revenue, it is important to be thorough and comprehensive. Ensure that you consider all sources of income and accurately record the figures. This may involve reviewing sales reports, financial statements, and other financial records. By having a clear picture of your total revenue, you can proceed with the calculation process confidently.

Determining the Quantity Sold

The next step is to calculate the quantity of goods or services sold during the chosen period. This can be done by analyzing sales records, invoices, or other relevant documentation.

When determining the quantity sold, it is essential to be precise and meticulous. Take into account all units of products or services that were sold, including any discounts, returns, or exchanges. By accurately determining the quantity sold, you can ensure the accuracy of the average revenue calculation.

Performing the Calculation

Once you have the total revenue and quantity sold, divide the total revenue by the quantity to calculate the average revenue per unit. This will provide a clear understanding of the average amount of revenue generated by each unit sold.

Performing the calculation is a straightforward process. Use a calculator or spreadsheet software to divide the total revenue by the quantity sold. The result will be the average revenue per unit. This metric is a valuable indicator of your business’s financial performance and can be used to compare against industry benchmarks or previous periods.

Remember, calculating average revenue is not a one-time task. It is an ongoing process that should be regularly reviewed and updated to reflect the changing dynamics of your business. By consistently monitoring and analyzing your average revenue, you can make informed decisions and drive your business towards success.

Common Mistakes in Calculating Average Revenue

Calculating average revenue is an essential task for businesses as it provides a measure of the revenue generated per unit of output. However, it is not uncommon for errors to occur during the calculation process, resulting in misleading figures. Let’s explore two common mistakes that businesses should be cautious of when calculating average revenue.

Overlooking Certain Revenue Streams

One common mistake is forgetting to include all revenue streams in the calculation. It is imperative to consider all sources of income, including auxiliary services, subscriptions, or royalties, to obtain an accurate average revenue figure.

For example, a company that offers a software product may generate revenue not only from the sale of the software itself but also from additional services such as technical support or training. Failing to account for these auxiliary revenue streams can significantly underestimate the true average revenue, leading to flawed decision-making.

Therefore, it is crucial for businesses to conduct a thorough analysis of all revenue sources and ensure that each one is appropriately included in the calculation. By doing so, they can obtain a more comprehensive and accurate average revenue figure, providing a clearer picture of their financial performance.

Incorrectly Counting Quantity Sold

Another mistake to avoid is miscounting the quantity of goods or services sold. Care must be taken to maintain an accurate record of the number of units delivered to customers, as this directly impacts the calculation of average revenue.

For instance, imagine a retail store that sells clothing items. If the store mistakenly records the wrong quantity of items sold, it can lead to an incorrect average revenue calculation. This error can occur due to various reasons, such as human error during data entry or inaccurate inventory management.

To prevent this mistake, businesses should implement robust systems and processes to track the quantity of goods or services sold accurately. This may involve using barcode scanners, implementing inventory management software, or conducting regular audits to ensure data accuracy.

By diligently monitoring and verifying the quantity sold, businesses can avoid errors that could skew the average revenue calculation and make informed decisions based on reliable financial data.

How to Use Average Revenue in Business Decisions

Now that we have explored the process to calculate average revenue, let’s discuss how this metric can be leveraged to make informed business decisions.

Pricing Strategies Based on Average Revenue

Average revenue provides valuable insights into the effectiveness of pricing strategies. By analyzing the relationship between average revenue and price, businesses can determine optimal pricing points and make adjustments to maximize profitability.

Forecasting and Budgeting with Average Revenue

Using average revenue in forecasting and budgeting helps businesses set realistic goals and align their financial plans accordingly. By considering historical data on average revenue, businesses can make accurate revenue projections and allocate resources effectively.

Calculate average revenue to optimize your financial performance and make informed decisions that drive growth and success.

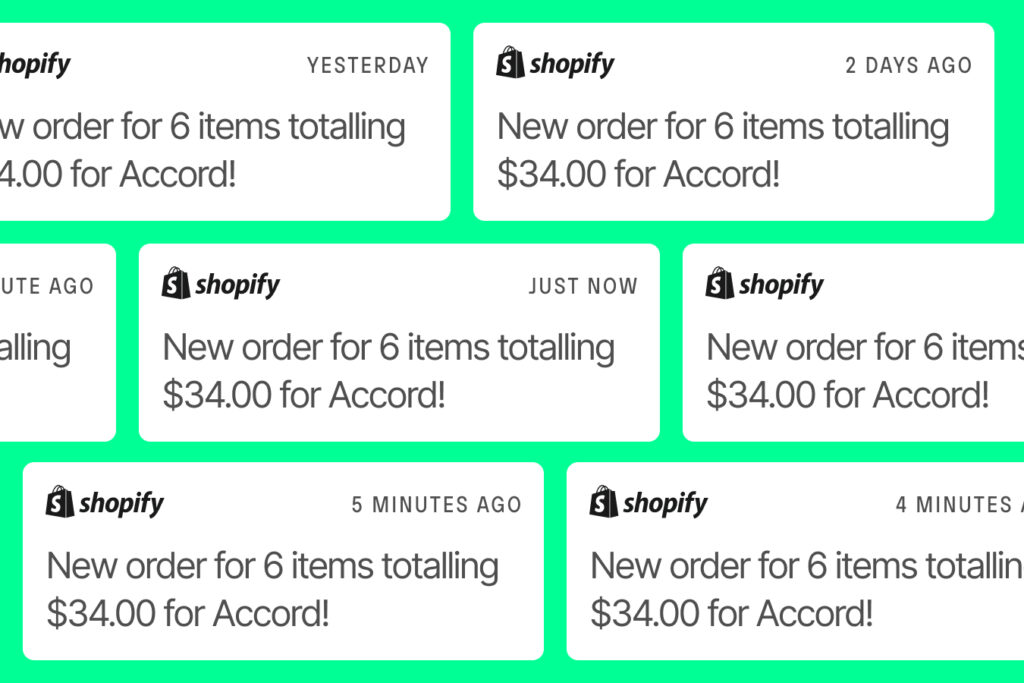

Stay on top of your eCommerce reporting.

Start today,

for free

Start a free trial of any of AMP’s tools today.