Feb 22, 2024

The Importance of Customer Lifetime Value Metrics.

To thrive in today’s competitive market, eCommerce businesses must understand the customer lifetime value (CLV). By analyzing these metrics, businesses can gain insights into their customer base, optimize strategies, and drive long-term profitability. This article explores the importance of CLV, its calculations, implementation challenges, and future trends.

Definition of Customer Lifetime Value Metrics

CLV is a powerful metric that measures the total revenue that a customer generates for a business throughout their relationship. It goes beyond immediate revenue and considers factors such as repeat purchases, average order value, and customer loyalty. By understanding CLV, businesses can accurately assess long-term profitability, prioritize resources effectively, and identify growth opportunities.

When analyzing CLV, businesses take into account various elements that contribute to the overall value of a customer. These factors include purchase frequency, average transaction value, and the length of the customer relationship. By considering these factors, businesses can gain a deeper understanding of the value of each customer and make informed decisions about resource allocation.

One of the key benefits of CLV metrics is their ability to provide insights into customer loyalty. By analyzing the CLV of different customer segments, businesses can identify their most loyal customers and tailor their marketing and retention efforts. This targeted approach ensures resources are focused on retaining high-value customers, leading to increased customer satisfaction and long-term profitability.

The Role of Customer Lifetime Value in Business Strategy

Integrating CLV metrics into business strategy is essential for a customer-centric approach. By considering the long-term value (LTV) of customers, businesses can tailor their marketing, sales, and retention efforts accordingly. Understanding which customers are most valuable allows for targeted initiatives that can optimize profitability, enhance customer satisfaction, and strengthen brand loyalty.

When incorporating CLV metrics into business strategy, companies can identify opportunities for growth and expansion. By analyzing the CLV of different customer segments, businesses can identify untapped potential and develop strategies to attract and retain high-value customers. This can involve personalized marketing campaigns, loyalty programs, or even product enhancements that cater specifically to the needs and preferences of these valuable customers.

Calculating Customer Lifetime Value Metrics

Customer lifetime value (CLV) is a crucial metric for businesses that want to understand the long-term value of their customers. It involves several key components that reflect different aspects of the customer relationship.

Key Components in Customer Lifetime Value Calculation

When calculating customer lifetime value, there are four key components that need to be considered.

Average Duration of the Customer Relationship:

This component refers to the average length of time a customer remains engaged with a business. It is important to accurately measure this duration as it directly impacts the overall CLV calculation.

Average Order Value:

The average order value represents the average amount of money a customer spends during each transaction. This metric helps in understanding the revenue generated from individual customers.

Average Purchase Frequency:

This component measures how often a customer makes a purchase within a given time period. It provides insights into customer loyalty and engagement levels.

Average Customer Acquisition Cost:

The average customer acquisition cost refers to the amount of money spent on acquiring new customers. It is important to consider this cost in CLV calculations to understand the profitability of acquiring and retaining customers.

Accurate calculations of customer lifetime value require reliable data and an in-depth understanding of customer behavior. By analyzing these key components, businesses can gain valuable insights into the long-term value of their customer base.

Common Mistakes in Calculating Customer Lifetime Value

While calculating customer lifetime value metrics, it is essential to be mindful of common mistakes that can lead to inaccurate results. By avoiding these pitfalls, businesses can ensure more reliable and insightful calculations:

Neglecting to Account for Customer Churn:

Customer churn refers to the rate at which customers stop engaging with a business. Failing to consider customer churn can significantly impact the accuracy of CLV calculations. It is crucial to include churn rate in the analysis to get a comprehensive understanding of customer lifetime value.

Relying on Incomplete or Biased Data:

Accurate CLV calculations heavily rely on reliable and comprehensive data. Using incomplete or biased data can lead to misleading results. It is important to gather data from various sources and ensure its accuracy and representativeness.

Failing to Differentiate Between Customer Segments:

Not all customers are the same, and their value to a business can vary. Failing to segment customers based on their characteristics and behaviors can lead to an inaccurate overall CLV calculation. It is crucial to analyze CLV metrics for different customer segments to gain a more nuanced understanding of their value.

By being aware of these common mistakes and implementing best practices, businesses can enhance the accuracy and reliability of their customer lifetime value calculations. This, in turn, can help them make informed decisions regarding customer acquisition, retention, and overall business strategy.

Utilizing Customer Lifetime Value Metrics for Business Growth

Customer lifetime value (CLV) metrics have become an essential tool for businesses seeking long-term profitability and growth. By understanding the value of each customer, businesses can identify strategies to improve customer satisfaction, increase loyalty, and reduce churn. But how exactly can businesses utilize CLV metrics to drive growth and success?

Improving Customer Retention with Lifetime Value Metrics

Customer retention is a critical factor in driving long-term profitability. By utilizing CLV metrics, businesses can gain valuable insights into customer behavior and preferences, allowing them to tailor their retention initiatives effectively. For example, by analyzing CLV data, businesses can identify the most profitable customer segments and develop personalized offers that cater to their specific needs and desires.

Moreover, CLV metrics can help businesses create and implement loyalty programs that incentivize customers to stay engaged and make repeat purchases. By offering exclusive rewards, discounts, or special promotions to their most valuable customers, businesses can foster a sense of loyalty and increase customer retention rates.

Exceptional customer service is another area where CLV metrics can make a significant impact. By identifying high-value customers, businesses can provide them with a personalized and exceptional customer experience. This can include dedicated account managers, priority support, or even surprise gifts or perks. By going above and beyond to exceed customer expectations, businesses can strengthen their relationship with valuable customers and increase their chances of long-term loyalty.

Enhancing Profitability through Customer Lifetime Value

While customer retention is crucial, CLV metrics can also be used to enhance profitability. By analyzing the data, businesses can identify the most valuable customer segments and focus their marketing efforts accordingly. This targeted approach allows businesses to allocate their resources wisely and maximize their return on investment.

One way businesses can enhance profitability using CLV metrics is by tailoring their product offerings. By understanding the preferences and purchasing patterns of their most valuable customers, businesses can develop new products or services that cater specifically to their needs. This not only increases customer satisfaction but also opens up new revenue streams and opportunities for growth.

In addition, CLV metrics can guide businesses in crafting targeted marketing campaigns. By identifying the characteristics and behaviors of their most valuable customers, businesses can create personalized messages and advertisements that resonate with their target audience. This level of customization increases the effectiveness of marketing efforts, leading to higher conversion rates and ultimately, increased revenues.

Optimizing pricing strategies is another way businesses can enhance profitability using CLV metrics. By understanding the value customers bring over their lifetime, businesses can set prices that align with the perceived value of their products or services. This ensures that customers feel they are receiving fair value for their investment, increasing the likelihood of repeat purchases and customer loyalty.

Overcoming Data Collection and Analysis Hurdles

Implementing customer lifetime value metrics often involves challenges related to data collection and analysis. Businesses need to ensure the accuracy and completeness of their data sources, integrate data from various touchpoints, and leverage advanced analytics tools for meaningful insights. Overcoming these hurdles requires a solid data infrastructure, data governance practices, and skilled analysts who can interpret and act upon the findings.

Addressing Organizational Challenges in Implementing Lifetime Value Metrics

Implementing customer lifetime value metrics effectively requires overcoming organizational challenges. This includes aligning departments to a customer-centric mindset, fostering collaboration between teams, and ensuring that key stakeholders understand the importance and value of CLV metrics. Communication and change management strategies are pivotal in driving successful implementation across the organization.

The Impact of Technology on Customer Lifetime Value Metrics

Advancements in technology are revolutionizing how businesses measure and utilize customer lifetime value metrics. Automation, artificial intelligence, and machine learning algorithms enable more accurate predictions, real-time analysis, and personalized customer experiences. As technology continues to evolve, businesses that embrace these innovations will have a competitive advantage in understanding and harnessing the power of customer lifetime value metrics.

As businesses strive to maximize their profitability and stay ahead of the competition, understanding and leveraging customer lifetime value metrics can make all the difference. By adopting a customer-centric approach and utilizing these metrics strategically, businesses can forge stronger relationships with their customers, optimize profitability, and position themselves for long-term success. With the comprehensive knowledge and insights provided in this guide, businesses can unlock the full potential of customer lifetime value metrics and take their strategies to new heights.

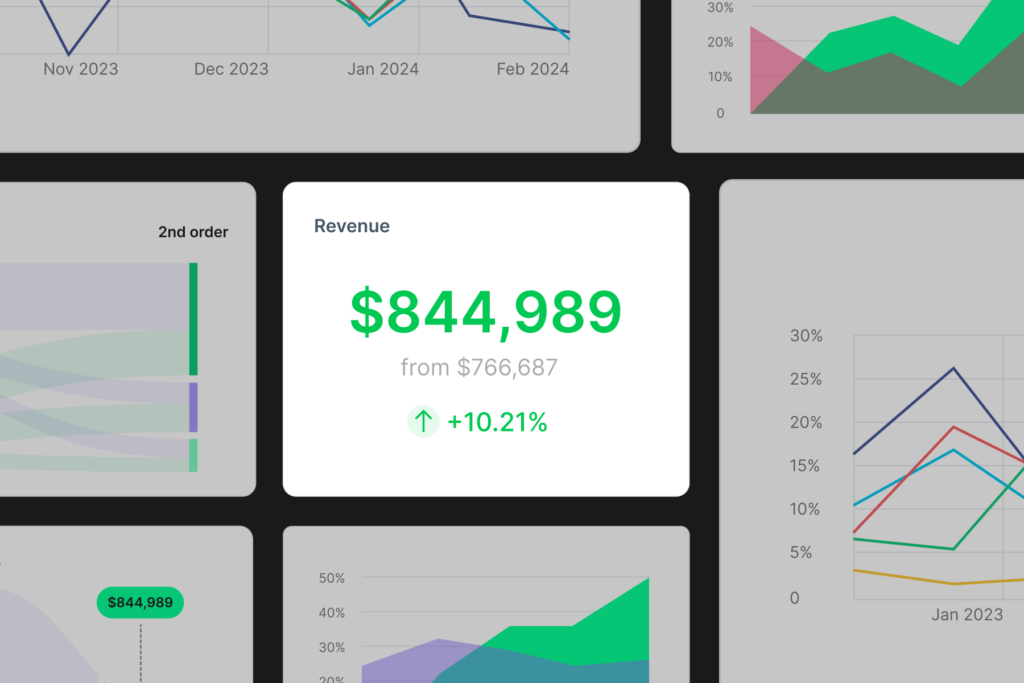

Instantly create cohort reports to see CAC & LTV.

Start today,

for free

Start a free trial of any of AMP’s tools today.