Feb 8, 2024

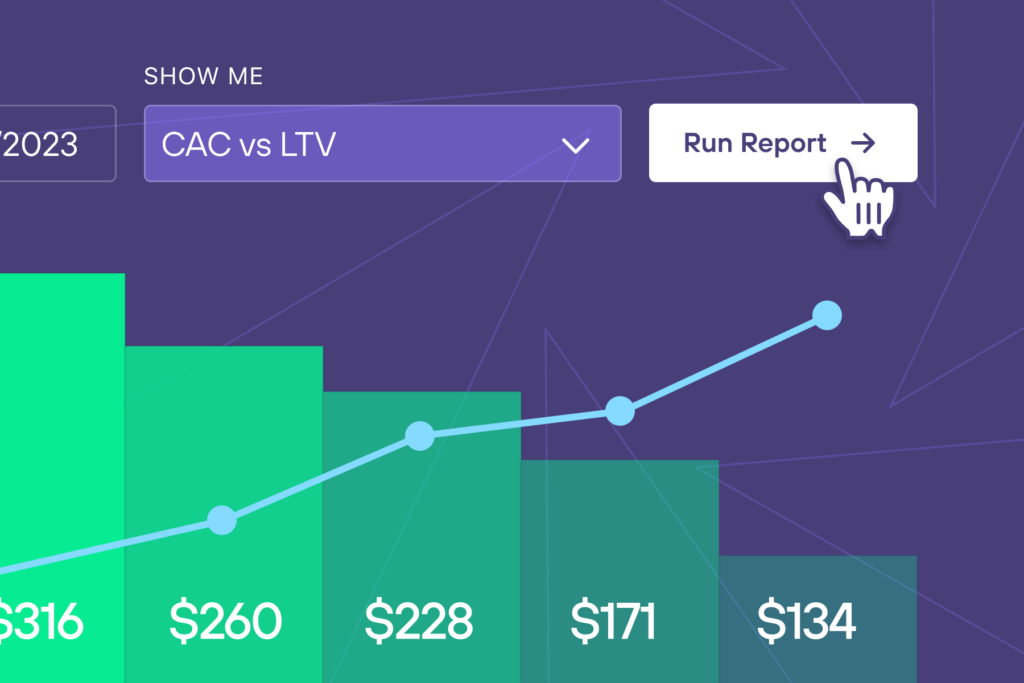

The Relationship Between CAC and CLV Explained.

What if you could foresee the future of your eCommerce business by using just two key metrics: Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV)?

These tools are crucial for every business owner, not just for financial experts. By understanding how to leverage CAC and CLV, you can optimize your marketing, improve profitability, and nurture long-term customer connections. In this article, we’ll simplify CAC and CLV, explain their calculation, and show how they contribute to building a successful online store.

Understanding Key Terms: CAC and CLV

Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) are two crucial metrics that businesses use to evaluate their marketing strategies and overall success. By understanding the meaning and significance of these terms, businesses can make informed decisions. This will help optimize their customer acquisition efforts and maximize the value they derive from each customer.

What is Customer Acquisition Cost (CAC)?

CAC refers to the total cost a business incurs to acquire a single customer. It includes various marketing and sales expenses, such as advertising, promotions, salaries, commissions, and overhead costs. To calculate CAC is total marketing campaign costs divided by the total customers acquired.

CAC is a vital metric as it helps businesses evaluate the effectiveness of their customer acquisition strategies. This will also help measure their return on investment (ROI).

When calculating CAC, businesses consider all the costs associated with acquiring new customers. This includes the expenses incurred in attracting potential customers, nurturing leads, and converting them into paying customers. By tracking and analyzing CAC, businesses can identify areas where they can optimize their marketing and sales processes to reduce costs and improve efficiency.

Furthermore, CAC provides businesses with insights into the profitability of their customer acquisition efforts. By comparing the CAC with the average revenue generated from each customer, businesses can determine whether their acquisition strategies are cost-effective and sustainable in the long run.

Defining Customer Lifetime Value (CLV)

CLV, represents the estimated total revenue a business expects to generate from a customer over their lifetime engagement. To calculate CLV is customer value multiplied by average customer lifespan.

CLV takes into account the customer’s average purchase value, purchase frequency, and duration of the business relationship. This metric allows businesses to assess the long-term value of their customers, make informed decisions regarding marketing efforts, customer retention, and satisfaction initiatives.

CLV is a valuable metric for businesses as it helps them understand the economic worth of acquiring and retaining customers. By estimating the potential revenue that can be generated from each customer, businesses can allocate resources effectively. This helps to acurately prioritize their marketing and customer retention strategies.

Moreover, CLV enables businesses to identify their most valuable customers and tailor their marketing efforts to maximize their engagement and loyalty. By understanding the lifetime value of their customers, businesses can develop personalized marketing campaigns, loyalty programs, and customer service initiatives that cater to the specific needs and preferences of their high-value customers. By comparing the CLV with the CAC, businesses can determine whether their acquisition strategies are generating sufficient returns and whether their customer retention efforts are effective in maximizing the lifetime value of their customers.

The Importance of CAC and CLV in Business

Both CAC and CLV are crucial metrics that provide valuable insights into a business’s overall performance, growth potential, and profitability. Let’s explore their significance individually.

Role of CAC in Business Growth

CAC plays a pivotal role in determining a business’s ability to grow its customer base efficiently. By accurately calculating CAC, organizations can evaluate the cost-effectiveness of their marketing and sales strategies. This information enables businesses to allocate resources optimally, identify the most profitable customer segments, and refine their acquisition tactics to attract high-value customers.

For example, let’s consider a software company that offers a range of products and services. By analyzing their CAC, they can identify which marketing channels and campaigns are generating the most cost-effective customer acquisitions. This insight allows them to reallocate their marketing budget towards the most successful channels.

Furthermore, by reducing CAC and enhancing customer acquisition efficiency, companies can accelerate their growth trajectory and achieve sustainable success. They can invest in strategies that not only attract new customers but also retain them, increasing overall CLV.

Why CLV Matters in Customer Retention

CLV is instrumental in measuring customer loyalty and retention, which are vital for the long-term success of any business. By understanding a CLV, organizations can identify the most valuable customers and invest in initiatives to maximize their satisfaction and loyalty.

For instance, let’s consider an eCommerce company that sells fashion apparel. By analyzing CLV, they can identify their most loyal and high-spending customers. Armed with this knowledge, they can personalize marketing campaigns, offer exclusive discounts, and provide exceptional customer service to enhance the overall customer experience.

Returning customers now spend on average 61% more than new customers, increased by upselling and trust with eCommerce stores. Moreover, CLV allows businesses to implement effective retention programs. By understanding the potential revenue a customer can generate throughout their lifetime, organizations can calculate the maximum amount they can invest in retaining that customer, with referrals having a higher retention rate of 37% and 16% CLV.

This knowledge helps businesses strike the right balance between customer retention efforts and costs, as it is 6 to 7 times more expensive to acquire a new customer than retain one.

A loyal customer not only brings repeat business but also becomes an advocate for the brand, attracting new customers through positive word-of-mouth.

The relationship between CAC and CLV is complex but interconnected. Let’s explore how these two metrics influence each other.

How CAC Influences CLV

It’s crucial to note that a high CAC can significantly impact CLV. When a business incurs high acquisition costs, it needs to generate substantial revenue to achieve a positive ROI. This necessitates increasing the CLV. By optimizing its marketing and sales efforts to reduce CAC, a company can allocate more resources towards customer satisfaction, loyalty, and retention.

The Impact of CLV on CAC

Conversely, CLV has a direct impact on CAC. When a business has a high CLV, it can afford to invest more in customer acquisition because the long-term value of each customer justifies the cost. Furthermore, customers with high CLV are more likely to provide positive referrals and recommendations, leading to lower customer acquisition costs through word-of-mouth marketing. Thus, by focusing on enhancing CLV, businesses can indirectly reduce their CAC and improve overall profitability.

Strategies to Optimize CAC and CLV

Now that we have explored the calculations, it’s time to discuss practical strategies to optimize CAC and CLV for enhanced business performance.

Reducing CAC for Better Profit Margins

Here are some strategies to reduce CAC:

- Segment your target market – Identify the most profitable customer segments and tailor your marketing efforts to target those specific segments. This approach ensures better utilization of resources and higher conversion rates.

- Optimize digital marketing channels – Leverage search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, and content marketing. This is to improve your online visibility and attract qualified leads at a lower cost.

- Implement referral programs – Encourage satisfied customers to refer your business to their network by providing incentives and rewards. Referral programs are cost-effective and can significantly reduce acquisition costs.

Enhancing CLV for Long-Term Business Success

Here are some strategies to enhance CLV:

- Focus on exceptional customer experiences – Prioritize customer satisfaction and loyalty by providing personalized experiences, prompt customer support, and valuable after-sales services.

- Implement customer loyalty programs – Design loyalty programs that incentivize repeat purchases and reward customers for their continued engagement with your brand.

- Invest in customer retention initiatives – Allocate resources toward initiatives that foster long-term customer relationships, such as personalized communication, exclusive offers, and proactive customer support.

By optimizing CAC and CLV simultaneously, businesses can improve their profitability, drive sustainable growth, and create a loyal customer base. Understanding the relationship between these two metrics is vital for making data-driven decisions and achieving long-term success in today’s competitive market. So, start analyzing your CAC and CLV today to unlock the full potential of your business!

Track profit, LTV & more in one beautiful tool.

Start today,

for free

Start a free trial of any of AMP’s tools today.