Dec 20, 2023

The Ultimate Guide to eCommerce Cashflow Forecasting.

Did you know that poor cash flow is one of the leading causes of small business failure? Whether you are running a small online business or a major eCommerce platform, cashflow is your secret weapon for financial stability. By accurately predicting your future cash inflows and outflows, you can make informed decisions and ensure security. Let’s explore why it’s so important, break down key elements and the steps to effective forecasting.

Understanding the Importance of Cashflow Forecasting

In the fast-paced world of eCommerce, maintaining a healthy cashflow is essential for sustainable growth. Cashflow refers to the movement of money into and out of your business. It determines your ability to meet financial obligations and seize opportunities for growth.

Cashflow forecasting involves predicting future cash inflows and outflows based on historical data, market trends, and your business’s unique circumstances.

When it comes to eCommerce, cashflow plays a crucial role in fueling every aspect of your business operations. It covers expenses like inventory purchase, production costs, marketing efforts, and staff salaries. Without a clear understanding of your cash inflows and outflows, you risk facing cash shortages, missed opportunities, and even potential bankruptcy.

The Role of Cashflow in eCommerce

Cashflow is the lifeblood that keeps your business running smoothly. It ensures that you have the necessary funds to pay your suppliers, invest in new products or technologies, and keep your marketing campaigns running. Without a healthy cashflow, your business may struggle to keep up with the demands of the market and may even face financial difficulties.

Imagine this scenario: you have a popular eCommerce store that sells trendy clothing. Your sales are booming, and customers are flocking to your website to make purchases. However, if you don’t have a clear understanding of your cash inflows and outflows, you may find yourself in a situation where you can’t afford to restock your inventory or pay your employees. This can lead to missed sales opportunities and a decline in customer satisfaction.

Benefits of Accurate Cashflow Forecasting

Accurate cashflow forecasting offers several benefits to eCommerce businesses. Firstly, it allows you to anticipate and plan for cash shortages or surpluses, enabling proactive financial management. By having a clear picture of your future cashflow, you can take steps to ensure that you have enough funds to cover your expenses and seize growth opportunities.

Secondly, accurate cashflow forecasting helps you identify potential funding needs or opportunities for investment. For example, if you forecast a cash surplus in the coming months, you may consider investing in new marketing campaigns or expanding your product line. On the other hand, if you anticipate a cash shortage, you can explore options for securing additional funding to bridge the gap.

Additionally, accurate cashflow forecasting enables you to make data-driven decisions, prioritize expenses, and allocate resources effectively. Instead of relying on guesswork or gut feelings, you can use historical data and market trends to guide your financial decisions. This can lead to more informed choices that maximize your return on investment and drive sustainable growth.

Key Elements of Cashflow Forecasting

When it comes to revenue projections, there are various factors to consider. Estimating your future sales and income streams can be based on historical data, industry trends, market analysis, and your marketing and sales strategies. By forecasting revenue, you can identify periods of high and low cash inflows, allowing you to plan for potential cash shortages or surpluses.

However, revenue projections are not just about numbers. They also involve understanding your target market and customer behavior. By delving into consumer preferences, purchasing patterns, and emerging trends, you can gain valuable insights into potential revenue streams. For example, if you’re running an eCommerce business, you might explore the growing popularity of online shopping and how it can impact your revenue projections.

Expense predictions, on the other hand, play a crucial role in managing your cashflow effectively. It’s not enough to simply estimate your expenses; you need to carefully review your fixed and variable costs. This includes considering expenses such as rent, utilities, supplies, employee salaries, marketing expenses, and any other expenditures associated with running your eCommerce business.

Accurately predicting your expenses requires attention to detail and a comprehensive understanding of your business operations. For instance, you might analyze your historical data to identify any seasonal fluctuations in expenses. This can help you anticipate periods where costs might increase, allowing you to plan accordingly and ensure you have sufficient cash reserves to cover them.

Having a clear picture of your cash inflows and outflows helps you identify any discrepancies or potential issues early on. By regularly reconciling your financial records and comparing them to your forecasted cashflow, you can spot any inconsistencies and take appropriate actions. This could involve following up on late payments, renegotiating terms with suppliers, or adjusting your spending to align with your cashflow projections.

Steps to Create an Effective Cashflow Forecast

Creating an effective cashflow forecast requires careful planning and analysis. By following these steps, you can ensure an accurate and reliable forecast for your eCommerce business.

Managing cashflow is crucial for the success of any business, especially in the fast-paced world of eCommerce. A well-prepared cashflow forecast allows you to anticipate and plan for future financial needs, make informed decisions, and ensure the smooth operation of your business.

Gathering Relevant Data

Start by collecting all relevant financial data, including historical sales records, previous cashflow statements, and financial projections. Additionally, consider gathering market research data, industry reports, and any other information that may influence your cashflow forecast. The more comprehensive your data, the more accurate your forecast will be.

When gathering financial data, it is important to ensure its accuracy and reliability. Double-check the numbers, verify the sources, and reconcile any discrepancies. Inaccurate or incomplete data can lead to misleading forecasts and poor decision-making.

Analyzing Past Trends

Review your historical data to identify trends and patterns that can inform your cashflow forecast. Look for seasonal fluctuations, sales cycles, and any other factors that may impact your cash inflows and outflows. By understanding your past performance, you can make more accurate predictions for the future.

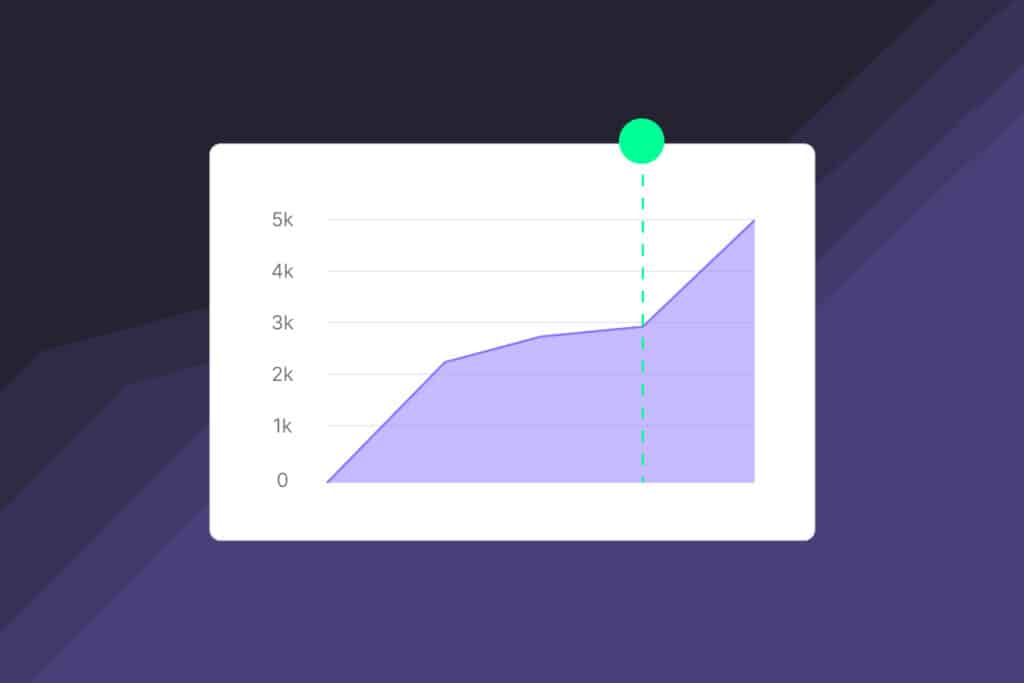

Consider using data visualization techniques such as charts and graphs to better understand the trends in your cashflow. Visual representations can provide valuable insights and help you identify key patterns that may not be immediately apparent in raw data.

Making Future Predictions

Based on your analysis of past trends, use this information to make future predictions. Consider factors such as market conditions, marketing campaigns, product launches, and any planned changes or initiatives that may impact your cashflow. Use different scenarios and assumptions to generate a range of possible outcomes.

It is important to remember that a cashflow forecast is not set in stone. As circumstances change, you may need to revise and update your forecast accordingly. Regularly reviewing and adjusting your forecast allows you to adapt to new opportunities or challenges that arise.

Furthermore, it is advisable to involve key stakeholders, such as your finance team or business partners, in the forecasting process. Their expertise and insights can provide a different perspective and help validate your predictions.

Creating an effective cashflow forecast requires a combination of data analysis, industry knowledge, and careful consideration of future factors. By following these steps and continuously refining your forecast, you can gain better control over your business’s financial health and make informed decisions to drive growth and success.

Implementing Cashflow Forecasting in eCommerce

Now that you understand the importance of cashflow forecasting and how to create an effective forecast, it’s essential to implement this practice into your eCommerce operations.

Choosing the Right Tools and Software

Invest in reliable cashflow forecasting tools and software that align with your business needs. These tools can automate data analysis, generate reports, and provide real-time insights into your cash position. Additionally, consider integrating your cashflow forecasting with your accounting and financial management systems for seamless operations.

Regular Monitoring and Adjustments

Cashflow forecasting is not a one-time activity but an ongoing process. Regularly monitor and update your forecast based on actual financial performance and any new insights or changes in your business environment. By staying vigilant, you can quickly identify any deviations or issues and take corrective actions to maintain a healthy cashflow.

Training Your Team for Cashflow Management

Ensure your team understands the importance of cashflow management and their role in the process. Provide training and resources to support them in making informed financial decisions. By fostering a culture of financial responsibility, you can collectively work towards optimizing your eCommerce business’s cashflow.

Effective cashflow forecasting is essential for eCommerce businesses. It allows you to anticipate and plan for future cash inflows and outflows, make informed financial decisions, and ensure the financial stability and growth of your business. By following the key elements and implementing the necessary steps, you can create an accurate and reliable cashflow forecast. Embrace cashflow forecasting as a vital tool for managing your eCommerce cashflow, and reap the benefits of proactive financial management and strategic decision-making.

Get a daily P&L for your store.

Start today,

for free

Start a free trial of any of AMP’s tools today.