Everything you need to know about CLV (Customer Lifetime Value)

What is CLV (Customer Lifetime Value)

Customer lifetime value (aka CLV, LTV, CLTV), refers to the total revenue a customer generates throughout their relationship with a business. It encompasses all purchases made by the customer across multiple transactions and allows businesses to assess the true worth of each customer.

Understanding CLV goes beyond tracking the monetary value of each transaction. It takes into account the entire relationship between the customer and the business. This includes repeat purchases, average order value, and customer loyalty. By looking at the bigger picture, businesses can accurately assess the true worth of each customer and make informed decisions about marketing strategies, product offerings, and customer retention efforts.

Why understanding lifetime value is important

Lifetime Value (LTV) is a critical metric for eCommerce businesses and should shape the overall growth strategy of online brands. One of the ways in which LTV impacts business strategy is through its influence on customer retention.

By understanding the value that each customer brings over their lifetime, businesses can tailor their strategies to focus on building loyalty and encouraging repeat purchases. Building loyalty is an important tactic for eCommerce brands as loyal customers tend to spend more over time, as they trust the brand and are more likely to make repeat purchases. Loyal customers also advocate for the brand and help to attract new customers.

Focusing on LTV allows businesses to identify and prioritize high-value customers. By analyzing customer data and segmenting customers based on their LTV, businesses can allocate resources more effectively. For example, they can invest more in retaining high-value customers who have the potential to generate significant revenue over time, rather than spreading resources thin across the entire customer base.

How to calculate Customer Lifetime Value (CLTV)

Lifetime value represents the profitability of a customer to a business. It takes into account not just the initial purchase but also subsequent purchases and customer loyalty. By calculating LTV, businesses can determine the true value of their customers and allocate resources accordingly.

Calculating LTV helps businesses assess the effectiveness of their marketing and sales efforts. By understanding the LTV of different customer segments, companies can focus their resources on acquiring and retaining high-value customers.

LTV also provides insights into customer loyalty and satisfaction. Higher LTV indicates customer loyalty and a positive customer experience, while a lower LTV may indicate issues that need to be addressed, such as product quality or customer service.

Finally, calculating LTV allows businesses to make informed decisions when it comes to pricing strategies, customer acquisition costs, and overall profitability. By understanding the revenue generated by each customer, businesses can optimize their pricing and marketing strategies for maximum profitability.

When calculating LTV, the first step is to identify the variables needed for the calculation. These variables include average order value, average purchase frequency rate, and customer lifespan. These metrics help in estimating the total revenue a customer is likely to generate over their engagement with the company.

Next, you need to determine the length of time a customer remains engaged with your business. This can be done by analyzing historical data and segmenting customers based on their tenure. Once you have the data, calculate the average lifespan for the customer segment of interest.

Thirdly, determine average order value and frequency by dividing the total revenue generated by a customer by the number of purchases made. AOV and purchase frequency shed light into how much customers are spending on average and how often they are making purchases.

Now that you have taken the necessary steps you can calculate LTV with the following formula;

LTV = Average Order Value x Average Purchase Frequency Rate x Customer Lifespan

By understanding and breaking down the components of LTV and following the steps to calculate it, businesses can gain valuable insights and drive profitability.

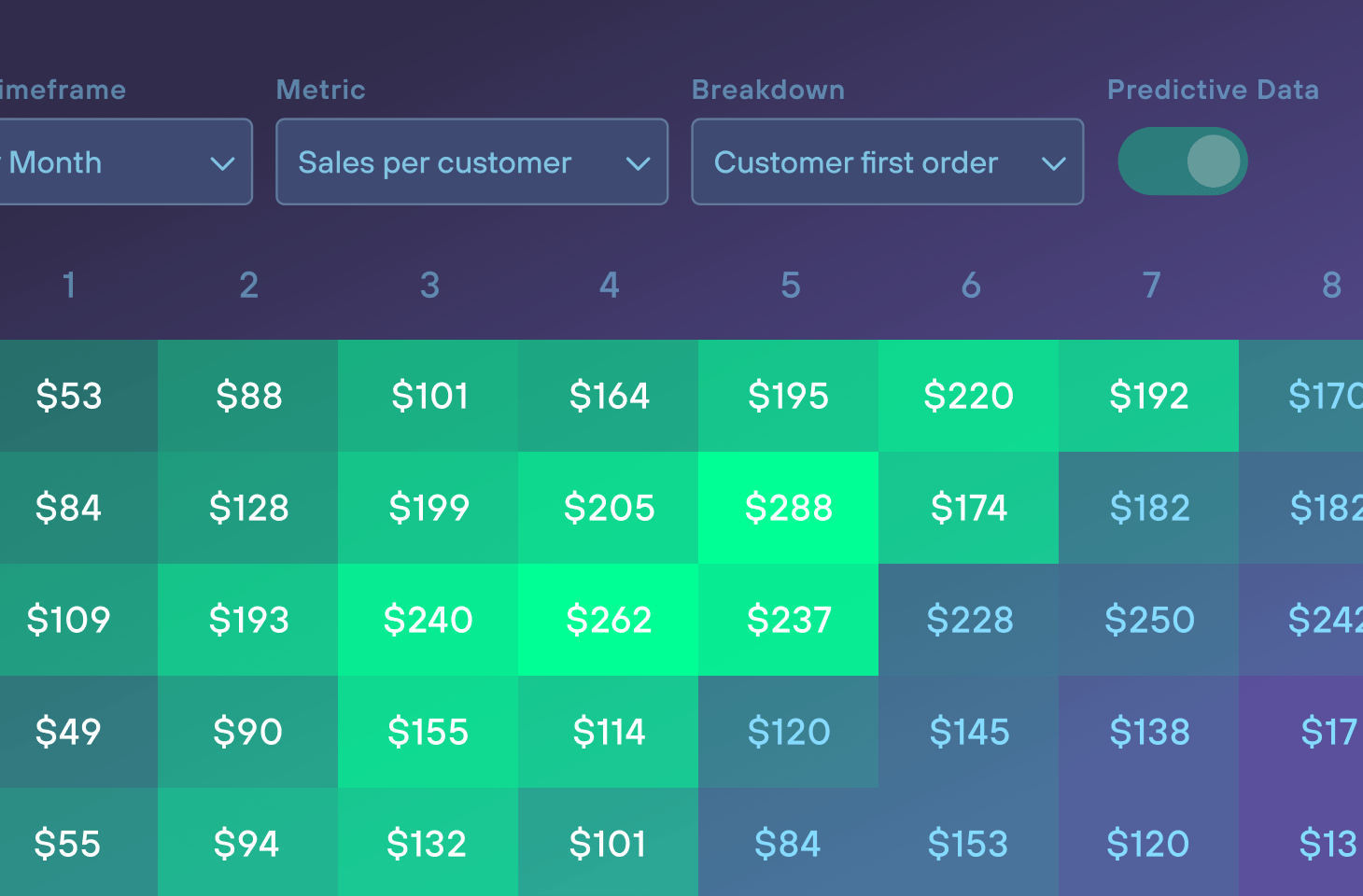

Segment your customers with cohort analysis for better CLV

When it comes to understanding customer behavior and optimizing business performance, segmenting your customers into cohorts is very useful. By grouping customers based on shared characteristics and analyzing their behavior and performance over time, businesses can gain valuable insights that can drive their marketing strategies and enhance overall success.

At its core, cohort analysis involves grouping customers based on shared characteristics and analyzing their behavior and performance over time. By tracking customer cohorts, businesses can identify patterns and trends that can help improve marketing strategies, optimize customer engagement, and enhance overall business performance.

By analyzing cohorts, you might discover that customers acquired through a specific marketing campaign have a higher customer lifetime value (CLV) compared to those acquired through other channels. Armed with this insight, you can allocate your marketing budget more efficiently and focus on acquiring customers likely to generate the greatest long-term value.

Furthermore, cohort analysis can help businesses identify trends and patterns in customer behavior. For instance, you may notice that customers who made their first purchase during a holiday season tend to have a higher average order value compared to customers who made their first purchase during non-holiday periods. Armed with this information, you can create targeted promotions and offers during holiday seasons to maximize sales and revenue.

Cohort analysis can also provide valuable insights into customer retention and churn rates. By analyzing cohorts, you can identify which groups of customers have the highest retention rates and which are more likely to churn.

Remember that cohort analysis is an iterative process. As you gain more insights from your analysis, you can refine your strategies and make data-driven decisions to further optimize your business performance.

CLV metrics: What to track alongside customer lifetime value

When analyzing CLV, businesses take into account various elements that contribute to the overall value of a customer. These elements include the frequency of purchases, the average amount spent per transaction, and the duration of the customer's relationship with the company.

When calculating customer lifetime value, there are four key components that need to be considered.

Average Duration of the Customer Relationship:

This component refers to the average length of time a customer remains engaged with a business. It is important to accurately measure this duration as it directly impacts the overall CLV calculation.

Average Order Value:

The average order value represents the average amount of money a customer spends during each transaction. This metric helps in understanding the revenue generated from individual customers.

Average Purchase Frequency:

This component measures how often a customer makes a purchase within a given time period. It provides insights into customer loyalty and engagement levels.

Average Customer Acquisition Cost:

The average customer acquisition cost refers to the amount of money spent on acquiring new customers. It is important to consider this cost in CLV calculations to understand the profitability of acquiring and retaining customers.

Accurate calculations of customer lifetime value require reliable data and an in-depth understanding of customer behavior. By analyzing these key components, businesses can gain valuable insights into the long-term value of their customer base.

Can you use CLV to reduce CAC?

Customer Lifetime Value (LCV), can be handy when managing your marketing budget or strategy.By understanding how much a customer may spend with your company over a period of time, you can work out your optimum cost per acquisition (CPA) for one customer.

This in turn will inform things like how much you spend on paid advertising, and how much to put into other marketing channels such as your content marketing, email or whatever else you need to pay out.

LTV tells you that customers are coming back. However, LTV does not tell you how many of your customers actually turn into repeat buyers, nor does it shed light into how long it takes for a new customer to make a second purchase. It does not tell you when to run winback campaigns or which products attract your highest value customers so that you can promote those in winback campaigns.

The first thing to determine after LTV is your repurchase rate. Repurchase rate refers to the percentage of customers who turn into repeat customers. A sudden dip in repurchase rate could indicate that you are acquiring a lower quality of customers from your acquisition funnels or it could be that your actual product has changed recently- affecting the repurchase rate.

Once you’ve understood the repurchase rate you can then delve into the actual time lag between orders. A time lag report calculates time between repeat orders for every customer during the selected time period and shows the distribution over time. Simply put- how many days does it take for a customer to make a repeat purchase?

Once you know your purchase frequency or repurchase rate, you have a data-backed time horizon to work with, to actually improve your LTV and reduce CAC. This will help you plan out a post-purchase marketing campaign that keeps you and your brand top-of-mind.

Strategies to increase Shopify LTV

Customer Lifetime Value (LTV) is a crucial metric that every Shopify store owner should understand in order to maximize their business’s profitability and success. Several factors affect customer lifetime value on Shopify. Understanding these factors is vital for developing effective strategies to increase LTV.

When it comes to customer lifetime value (LTV) on Shopify, there are numerous key factors that play a significant role in determining the success of an online store. By delving deeper into these factors, merchants can gain valuable insights into how to maximize LTV and drive sustainable growth.

One of the key strategies to increase LTV is enhancing the customer experience. Providing an exceptional customer experience is crucial for encouraging repeat purchases and building long-term customer relationships. This includes ensuring a user-friendly website that is easy to navigate and visually appealing. By optimizing the website’s design and layout, you can create a seamless browsing experience for customers, increasing the likelihood of them staying on your site and making a purchase.

Personalized recommendations are another important aspect of enhancing the customer experience. By leveraging data analytics and customer behavior insights, you can offer tailored suggestions to customers based on their previous purchases and browsing history. This not only makes the shopping experience more convenient for customers but also increases the chances of them discovering new products they may be interested in.

In addition to personalized recommendations, hassle-free checkout processes are essential for maximizing customer lifetime value. Implementing features such as guest checkout, saved payment information, and one-click ordering can significantly reduce friction during the checkout process, making it more convenient for customers to complete their purchases. This streamlined experience increases the likelihood of customers returning to your store in the future.

Excellent post-purchase support is another crucial element of enhancing the customer experience. By providing prompt and helpful assistance to customers after they make a purchase, you can build trust and loyalty. This can be achieved through various channels such as email, live chat, or a dedicated customer support hotline. By addressing any concerns or issues promptly, you can ensure customer satisfaction and increase the chances of repeat purchases.

By consistently focusing on increasing LTV, you can ensure the sustained success of your Shopify store.

How tracking LTV can help your Amazon business

The decision to expand and sell on Amazon is a tried and tested growth strategy for many Shopify native brands. However the path to maintain overall profitability across two sales channels is not as straightforward. Of the many challenges that merchants face, deciding on marketing spend and strategy is a significant one.

How do your Amazon customers differ from your Shopify ones? Are your Amazon marketing efforts bearing fruit?

Measuring Customer Lifetime Value can help you with this analysis. Unlike traditional KPIs like sales revenue or click-through rates, LTV looks beyond the immediate impact of outreach techniques, and sheds light on how today’s marketing efforts could affect the bottom line in the long run.

The LTV report helps brands better understand how and why different subsets of customers on Amazon are more valuable than others, and give you the data to make important decisions such as:

- How much can I afford to spend to acquire new customers?

- Which of my marketing initiatives should I abandon, and which should I scale up?

- Which product categories should I expand to maximize long-term profits?

Finally tracking LTV also lets you compare your Amazon customers to your store customers and evaluate how to distribute your marketing budget between the two, depending on how each cohort converts.